Conventional management wisdom emphasizes aligning company goals, properly resourcing projects, and executing tasks according to plan. The implicit assertion is that this discipline will put the proper structure in place to ensure strong decision-making.

A surprising insight from new Decision IQ research reveals that this common wisdom is only half the story.

Misaligned companies that can’t execute well are unlikely to be successful. So in that sense, strong alignment and execution are prerequisites for effective decision-making.

However, as the research white paper details, many companies with strong alignment and execution skills regularly make decisions that deliver lackluster business value. Instead, companies that apply management discipline to the decision-making process have the strongest decision outcomes.

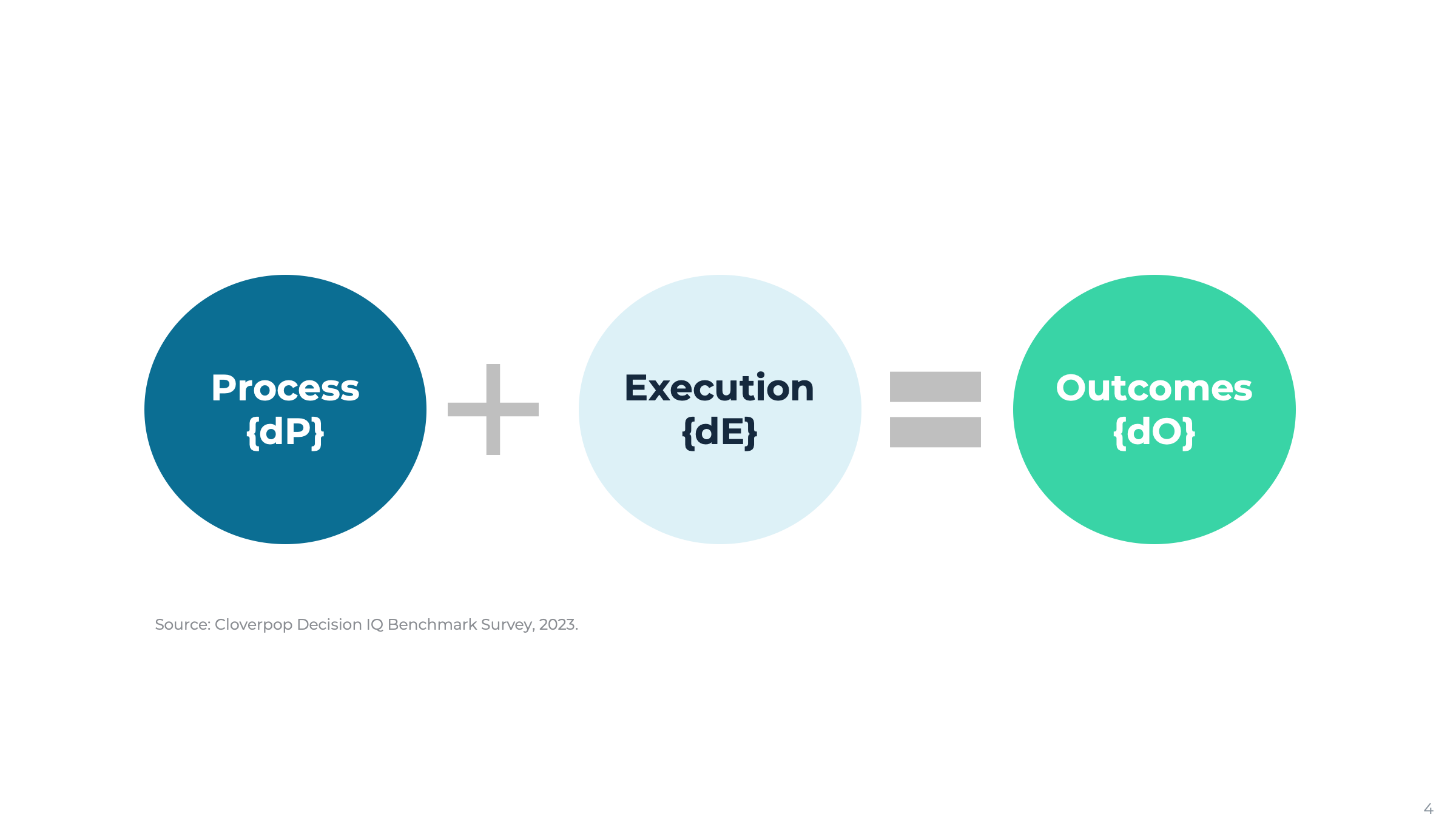

The Decision Equation

As described in the research paper, the foundation of the Decision IQ framework is a simple equation:

Process, measured as {dP}, includes all the steps that go into making decisions and evaluating the decision-making process over time. Execution, measured as {dE}, covers the business's actions to implement decisions and drive results once decisions are made. Finally, Outcomes, {dO}, measures the overall success of a company’s decision results relative to expectations. This framework builds on previously published research into decision checklists, inclusive decision-making, and effective corporate decision practices.

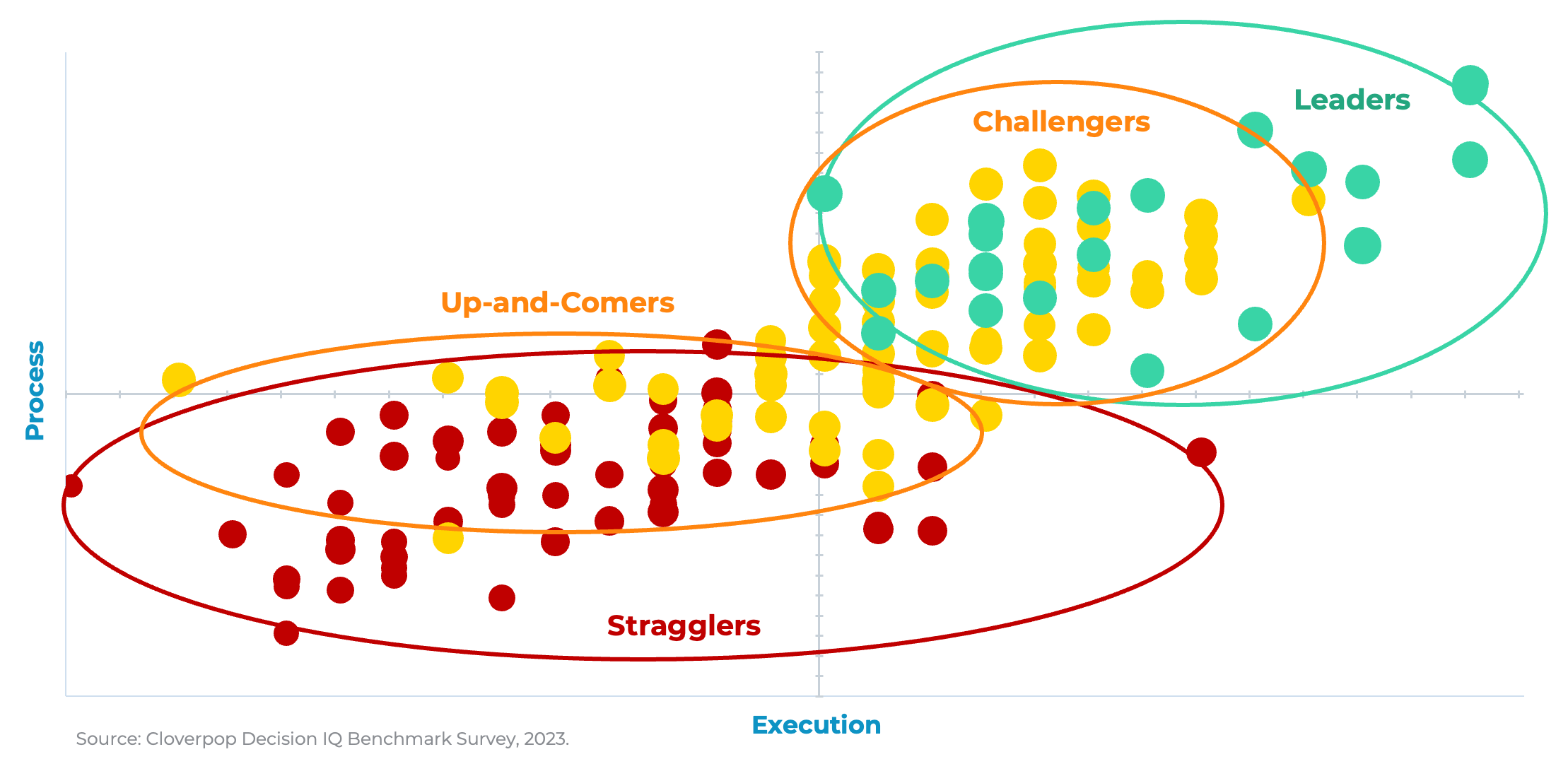

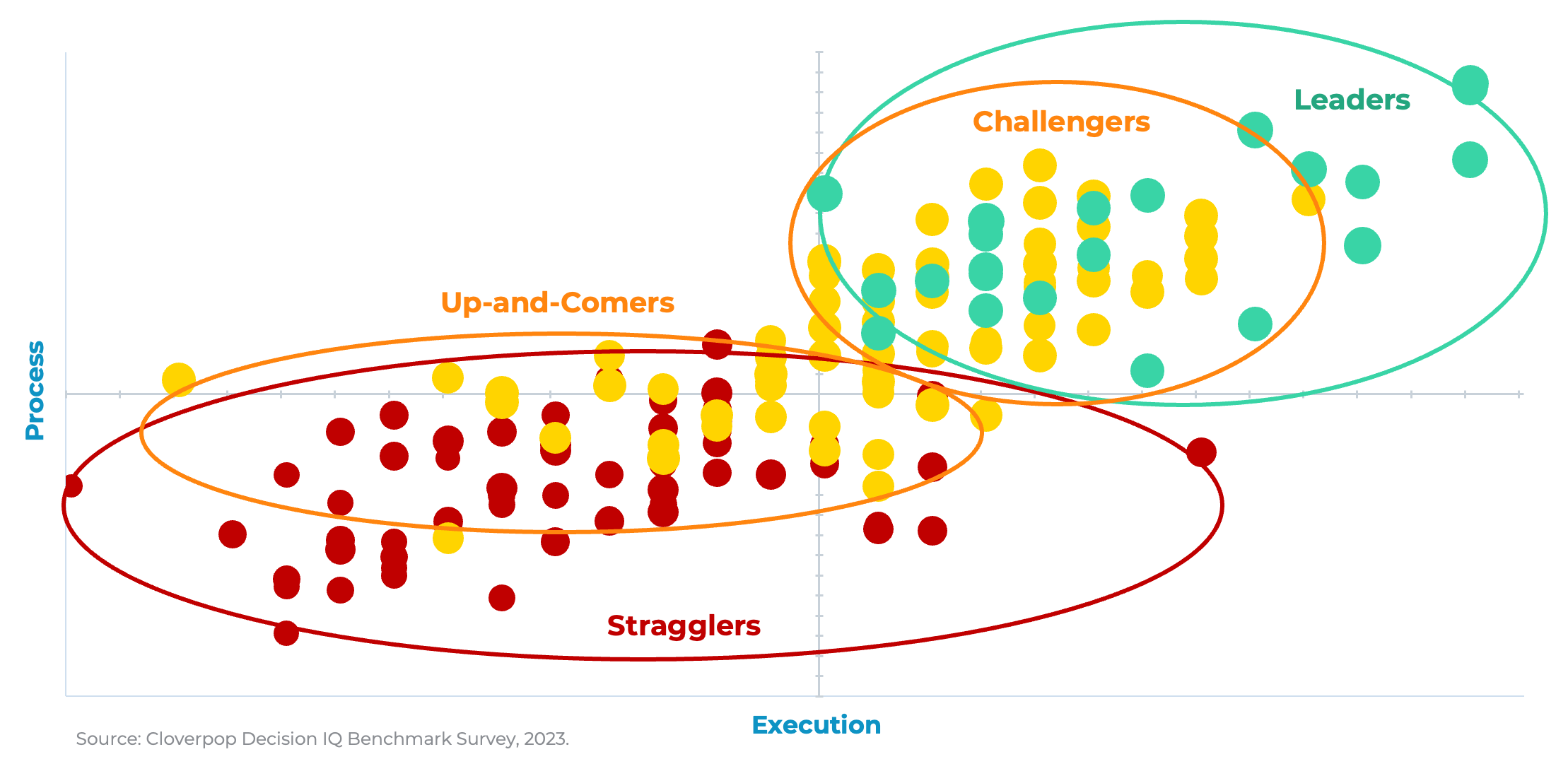

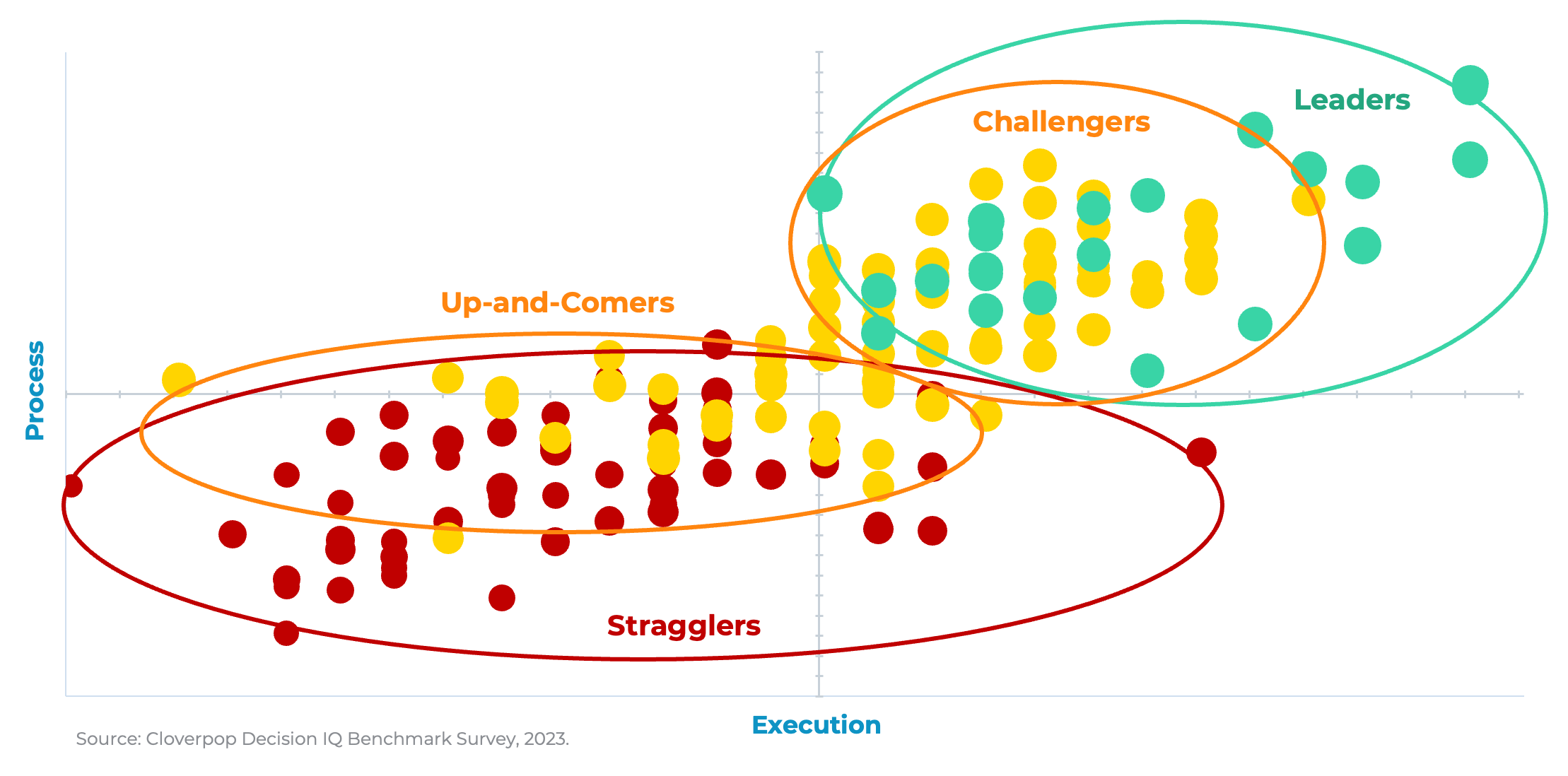

Mapping Decision IQ Maturity Levels

The 2023 Decision IQ benchmark database included surveys of 160 companies, primarily large consumer goods, pharma, manufacturing, financial services and technology companies. The research maps companies into four distinct maturity levels: Leaders, Challengers, Up-And-Comers and Stragglers.

According to the research, companies at each maturity level have a consistent pattern of strengths and weaknesses.

Leaders

These companies represent the top 15 percent of benchmarked organizations. Leaders excel at both Execution and Process across the board and consistently deliver strong decision Outcomes (green dots on the graph above).

Challengers

The next 25 percent of benchmarked companies are on the cusp of excellence. Overall, Challengers have high scores for decision Process and Execution but average scores for decision Outcomes (yellow dots). Close inspection of their decision-making processes reveals a few consistent shortcomings:

- They decide more slowly and less firmly than Leaders, with fewer people empowered to make decisions.

- They sometimes struggle to communicate decisions as clearly and quickly, and stakeholders are less likely to support decisions when they disagree.

- They more often forget why they made decisions because they are less likely to record decisions and track their effectiveness over time.

- They are less likely to evaluate past decisions, share lessons learned and quickly identify and fix bad decisions.

These gaps hold Challengers back from the Leaders’ strong decision outcomes.

Up-And-Comers

The next group covers the middle 20 percent of companies. Like Challengers, Up-And-Comers deliver average decision Outcomes (yellow dots). However, their Process and Execution scores are lower, and these companies have more pronounced struggles with the decision difficulties Challengers face. As described in the research, Up-And-Comers also have additional decision-making problems:

- They sometimes lack clear frameworks, logical structures and flows for decisions, and people struggle to find needed information.

- They miss the goldilocks zone of analysis and discussion – some fall into analysis paralysis and death by meetings, while others rely too much on dictatorial gut instincts.

- They fail to consistently involve the right stakeholders or ensure that their input is given appropriate weight.

Also, while the chart shows that Up-And-Comers have decision Process scores (vertical axis) that cluster tightly around the median, they have a wide range of Execution scores (horizontal spread). This finding reflects that when it comes to the business value of decisions, the importance of the decision-making Process eclipses the impact of Execution afterward. The only way to get good results flawlessly executing a bad decision is to get lucky.

Stragglers

That leaves the bottom 40 percent of companies, those with low Process and Execution scores and weak decision Outcomes (red dots). These Stragglers regularly struggle with profound difficulties in all aspects of the decision Process, often further compounded by relatively weak Execution skills.

Leveling Up Corporate Decision IQ

These research results show that companies' decision-making activities can be benchmarked and compared to competitors. Leaders regularly follow benchmark practices and reap the rewards of good decisions, while Stragglers rarely do. Challengers and Up-And-Comers muddle along with middling decision results due to a few consistent Process shortcomings.

Decision-making is the most valuable business activity — landmark research from Bain and Co. found that decision effectiveness drives 95 percent of company performance. Improving decision-making is the surest way to increase business value, and the Decision IQ research reveals that 85 percent of companies have the opportunity for significant improvement.

Where does your company stand? Do you follow checklists and standard structured frameworks for high-quality decision-making? Are people trained to make better, faster decisions? Is inclusive decision-making standard practice?

Questions like those only become more urgent as the ever-increasing pace of change drives the ever-increasing importance of decision-making. Execution excellence is no longer enough. Decision process excellence is the key to leveling up your company’s Decision IQ.

This article was originally published in Forbes.